Here is the brief description of the guidelines related to the Dairy Entrepreneurship Development Scheme (DEDS), we mentioned previously.

A. Implementing period and Area of operation

The scheme will be implemented during the remaining XI plan period through out the country with out restrictions applicable to Operation Flood areas for financing of milch animals. The scheme will come into effect from 1 September 2010.

B. Eligibility

- Farmers, individual entrepreneurs, NGOs, companies, groups of unorganized and organized sector etc. Groups of organized sector include self help groups, dairy cooperative societies, milk unions, milk federations etc.

- An individual will be eligible to avail assistance for all the components under the scheme but only once for each component

- More than one member of a family can be assisted under the scheme provided they set up separate units with separate infrastructure at different locations. The distance between the boundaries of two such farms should be at least 500m.

C. Subsidy

The capital subsidy will be back ended with minimum lock-in period of 3 years.

D. Components that can be financed

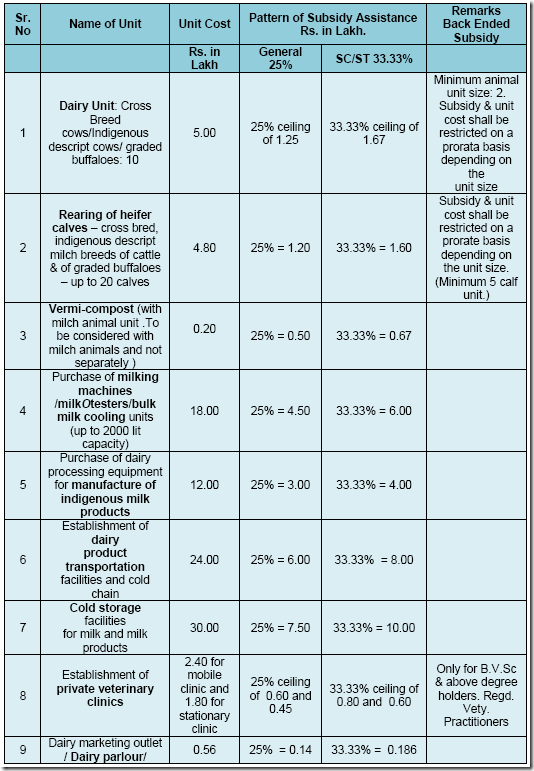

Indicative unit cost and pattern of assistance are given below:

E. Funding pattern

- Entrepreneur contribution ( margin) - 10 % of the outlay ( minimum)

- Back ended capital subsidy - as indicated above at 5.1.

- Effective Bank Loan - Balance portion, Minimum of 40% of the outlay

F. Linkage with credit

Assistance under the scheme would be purely credit linked and subject to sanction of the project by eligible financial institutions. After the disbursement of first installment of the loan, the bank shall apply to the concerned Regional Office of NABARD for sanction and release of subsidy in the format given in Annexure I.

G. Eligible financial institutions

- Commercial Banks

- Regional Rural Banks

- State Cooperative Banks

- State Cooperative Agriculture and Rural Development Banks, and

- Other such institutions, which are eligible for refinance from NABARD.

The entrepreneurs shall apply to their banks for sanction of the project. The subsidy shall be released on first come first serve basis subject to availability of funds.

E. Repayment

- Repayment Period will depend on the nature of activity and cash flow and will vary between 3- 7 years. Grace period may range from 3 to 6 months in case of dairy farms to 3 years for calf rearing units (to be decided by the financing bank as per needs of individual projects).

- The recovery of loan will be based on net loan amount only. i.e. not including subsidy, which will be adjusted by the concerned bank after effective bank loan and interest thereon has been repaid. i.e. the repayment schedules will be drawn on the total amount of the loan (including subsidy) in such a way that the subsidy amount is adjusted after liquidation of net bank loan (excluding subsidy).

F. Rate of Interest

Rate of interest on the loans shall be as per RBI guidelines and declared policy of the concern bank.

G. Security

The security for availing the loan will be as per guidelines issued by RBI from time to time.

H. Time limit for Completion of the project.

- Time limit for completion of the project (except for calf rearing units where disbursements are expected to continue till two years) would be as envisaged under the project, subject to maximum of 9 months period from the date of disbursement of the first installment of loan which may be extended by a further period of 3 months, if reasons for delay are considered justified by the financial institution concerned.

- If the project is not completed within the stipulated period, benefit of subsidy shall not be available and advance subsidy placed with the participating bank, if any, will have to be refunded forthwith to NABARD.

Note: For detail circular on the scheme, visit : www.nabard.org and www.dahd.nic.in